Taxlegit Services Guide: Company Registration and Compliance

Introduction

Starting and registering a business requires proper legal understanding and correct documentation. Taxlegit provides professional assistance for company registration and government registrations in India. This guide explains three important areas: minimum no of members in a public company, MSME Registration Required Documents, and Startup India Registration, as handled by Taxlegit.

1. Minimum No of Members in a Public Company

The minimum no of members in a public company is defined under the Companies Act, 2013. A public limited company must have:

Minimum 7 shareholders

Minimum 3 directors

At least one director must be an Indian resident

There is no restriction on the maximum number of members in a public company.

Key Points Handled by Taxlegit

Taxlegit assists in:

Drafting Memorandum and Articles of Association

Director Identification Number (DIN) application

Digital Signature Certificate (DSC) processing

Filing incorporation forms with the Ministry of Corporate Affairs

Taxlegit ensures that the company structure meets the legal requirement of minimum members and directors before filing the incorporation application.

2. MSME Registration Required Documents

MSME registration provides official recognition to small and medium enterprises under the Government of India. Proper documentation is necessary for successful registration.

MSME Registration Required Documents

The following documents are generally required:

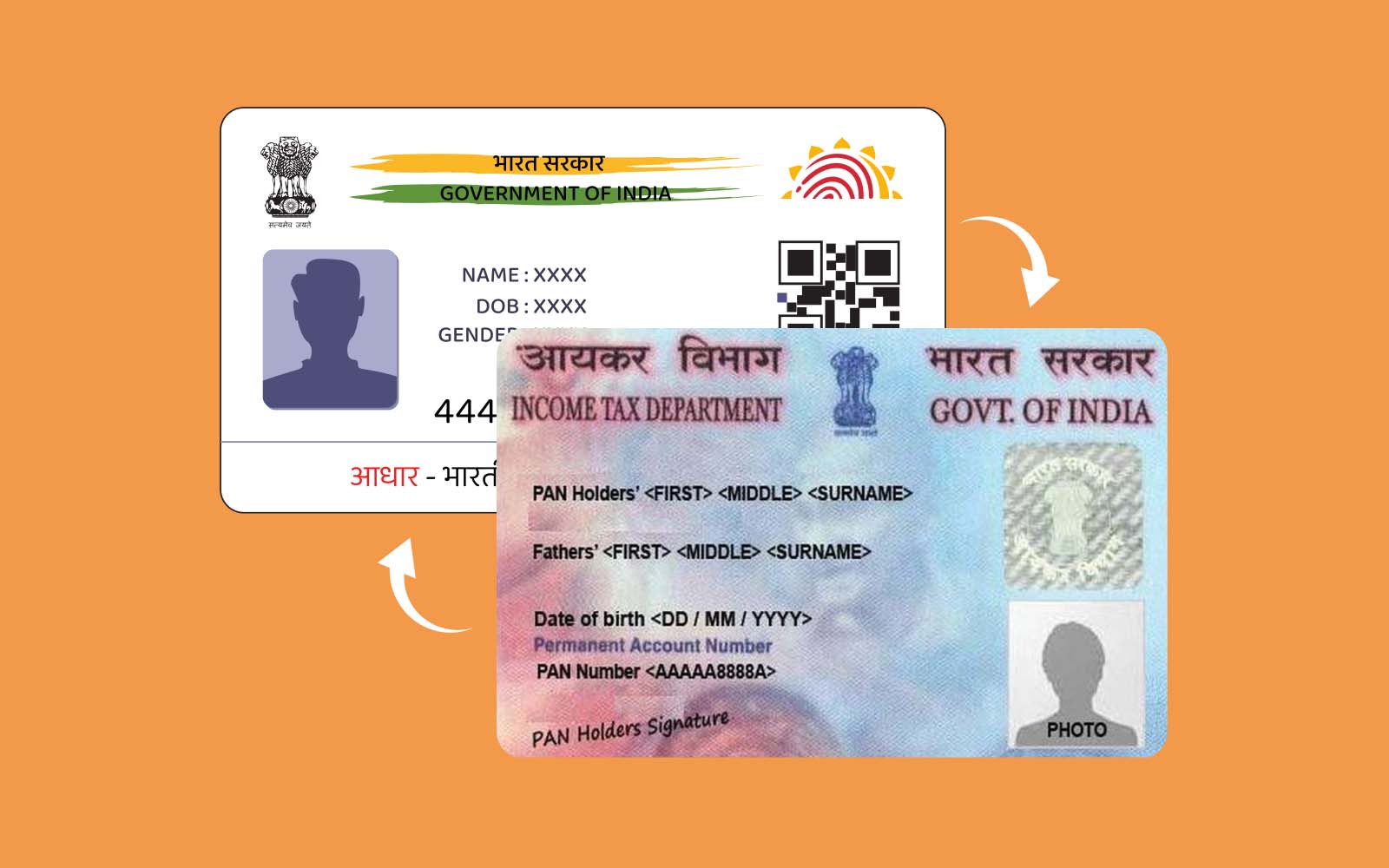

Aadhaar Card of the applicant

PAN Card of the business or proprietor

Business address proof

Bank account details

Business activity information

Taxlegit verifies the documents and files the MSME application through the official Udyam portal. The team ensures accurate information submission to avoid rejection or delay.

How Taxlegit Supports MSME Registration

Taxlegit provides:

Document verification

Application filing

Correction support if required

Assistance in downloading the MSME certificate

The process is handled carefully so that businesses receive their registration certificate without unnecessary complications.

3. Startup India Registration

Startup India Registration is designed for eligible startups seeking recognition under the Startup India initiative of the Government of India.

Eligibility for Startup India Registration

A business must generally:

Be incorporated as a private limited company, LLP, or registered partnership

Be less than 10 years old

Have annual turnover within prescribed limits

Work towards innovation, development, or improvement of products or services

Documents Required for Startup India Registration

Certificate of incorporation

PAN of the company

Details of directors or partners

Brief description of business activities

Supporting documents for innovation (if applicable)

Taxlegit Assistance for Startup India Registration

Taxlegit handles:

Eligibility review

Document preparation

Online application submission

Follow-up for recognition approval

The team ensures that the application is complete and properly structured before submission.

Conclusion

Understanding the minimum no of members in a public company, arranging the correct MSME Registration Required Documents, and applying for Startup India Registration are important steps in business formation and recognition.