According to IMARC Group’s latest report titled "India Base Transceiver Station Market Size, Share, Trends and Forecast by Component, Network Technology, Deployment, End User, and Region, 2025-2033", the market is witnessing robust growth driven by the rapid expansion of 4G and 5G networks and increasing investments in urban connectivity infrastructure. The study offers a profound analysis of the industry, encompassing India base transceiver station market outlook, share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics, including the deployment of distributed antenna systems (DAS) in high-rise buildings, the push for energy-efficient BTS solutions, and the strategic consolidation of tower installations by major telecom operators.

Market At-A-Glance: Key Statistics (2025-2033):

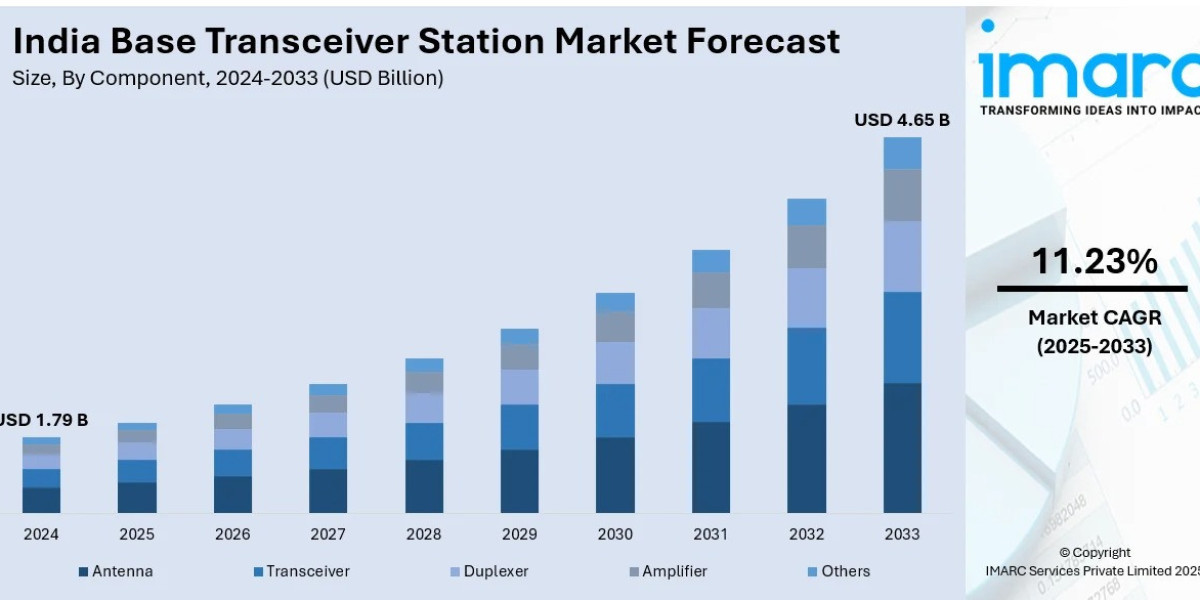

- Current Market Size (2024): USD 1.79 Billion

- Projected Market Size (2033): USD 4.65 Billion

- Growth Rate (CAGR): 11.23%

- Key Drivers: Rising mobile subscriber base, government initiatives like Smart Cities Mission, and demand for seamless connectivity in dense urban areas.

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-base-transceiver-station-market/requestsample

India Base Transceiver Station Market Overview

The India base transceiver station market size reached USD 1.79 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.65 Billion by 2033, exhibiting a double-digit growth rate (CAGR) of 11.23% during 2025-2033.

The market is primarily driven by the massive scale of India's telecom sector, with a mobile user base projected to hit 1.42 billion by 2024. The surge in affordable smartphones and cheap data plans has exponentially increased the load on existing networks, necessitating the widespread installation of additional Base Transceiver Stations (BTS) to ensure coverage and capacity. The market is also benefiting from rapid urbanization; the rising number of high-rise residential and commercial complexes is creating "dead zones" that require specialized solutions like small cells and Distributed Antenna Systems (DAS). Furthermore, government-led infrastructure projects, including the Smart Cities Mission and Pradhan Mantri Awas Yojana-Urban 2.0, are creating new avenues for deploying advanced telecom infrastructure to support high-speed data transmission and digital services.

Top Emerging Trends in the India Base Transceiver Station Market:

- 5G Network Rollout: The transition to 5G is a major catalyst, requiring denser networks and advanced base stations capable of supporting higher speeds and lower latency.

- Urban Densification: Increasing investments in small cell BTS and DAS to provide reliable connectivity in high-density urban environments and underground structures (metros, tunnels).

- Infrastructure Consolidation: Major operators like Reliance Jio and Bharti Airtel are entering a phase of consolidation after extensive initial rollouts, focusing on optimizing existing tower networks.

- Rural Connectivity: Initiatives like Digital India and the deployment of towers in remote areas (e.g., BSNL's high-altitude stations in Siachen) to bridge the digital divide.

India Base Transceiver Station Market Growth Factors (Drivers)

- Smartphone Penetration: Widespread adoption of 4G-enabled devices driving the need for robust network backbones.

- Data Consumption: Exponential growth in mobile data usage for streaming, gaming, and remote work pushing operators to upgrade capacity.

- Government Support: Policy initiatives and funding for urban housing and smart infrastructure directly correlating with increased demand for connectivity solutions.

- Enterprise Digitization: Adoption of cloud services and IoT by businesses necessitating seamless, uninterrupted mobile connectivity.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-base-transceiver-station-market

Market Segmentation

Analysis by Component:

- Antenna

- Transceiver

- Duplexer

- Amplifier

- Others

Analysis by Network Technology:

- 2G

- 3G

- 4G

- 5G

Analysis by Deployment:

- Indoor

- Outdoor

Analysis by End User:

- Telecommunications

- Defense

- Transportation

- Others

Regional Insights:

- North India

- South India

- East India

- West India

India Base Transceiver Station Market Recent Developments & News

- August 2024: The Department of Telecommunications (DoT) announced that over 450,000 5G base transceiver stations have been established across India.

- Strategic Moves: Reliance Jio and Bharti Airtel signaled a shift towards consolidation of their tower assets to improve operational efficiency.

- BSNL Expansion: BSNL inaugurated a BTS at the Siachen Glacier (over 15,500 feet), marking a milestone in providing connectivity to the armed forces in extreme terrains.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Indoor vs. Outdoor deployment trends, helping infrastructure providers target the right venues.

- Technological Shift: Insights into the transition from legacy 2G/3G systems to 4G/5G infrastructure.

- Regional Opportunities: Identification of high-growth zones in North and South India driven by urbanization and industrial hubs.

- Competitive Intelligence: Understanding the strategic positioning of key telecom operators and equipment suppliers.

Key Highlights of the Report

- Market Forecast (2025-2033): Quantitative data on market value and rapid growth.

- Competitive Landscape: Comprehensive analysis of market structure and key players.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into the adoption of energy-efficient and green BTS technologies.