While the public eye is fixed on the dazzling speeds of Mach 5 missiles, the true battle for hypersonic dominance is being fought in mines, factories, and research labs. A weapon system is only as strong as its weakest component, and currently, the Hypersonic Weapons Market rests on a supply chain that is alarmingly fragile. The transition from building a few experimental prototypes to mass-producing thousands of operational units is exposing severe structural cracks in the industrial base. For investors and defense planners, these "unsexy" logistical hurdles—ranging from rare earth dependency to workforce shortages—represent the single greatest restraint on market growth. In this deep dive, we explore the hidden vulnerabilities of the hypersonic ecosystem and the strategic investments being made to fix them.

The Critical Materials Crunch: A Geopolitical Stranglehold

The most immediate threat to the hypersonic supply chain is the scarcity of raw materials required to survive the extreme environments of high-speed flight. Hypersonic vehicles must withstand temperatures exceeding 2,000°C, requiring exotic materials that are difficult to source and process.

The Rare Earth Dilemma:

High-performance permanent magnets, essential for the guidance systems and actuators that steer these missiles, rely heavily on heavy rare earth elements like Dysprosium and Terbium. Currently, China controls approximately 70% of the global refining capacity for these minerals. This dependency creates a massive strategic risk for Western nations. A single export restriction could theoretically ground production lines overnight. Consequently, we are seeing a rush of government funding into "friendly-shoring" initiatives—opening new mines and processing facilities in Australia, the US, and Canada to create a parallel supply chain.

Carbon-Carbon Composites:

The nose cone and leading edges of a hypersonic glider endure the brunt of the thermal friction. Standard aerospace aluminum would melt instantly; thus, manufacturers use Carbon-Carbon (C/C) composites. However, the industrial base for this material is dangerously thin. In the United States, for instance, there are fewer than five major suppliers capable of producing aerospace-grade C/C at scale. Ramping up production is not simple; the manufacturing process involves complex chemical vapor infiltration cycles that can take months to complete.

Manufacturing at the Edge of Physics

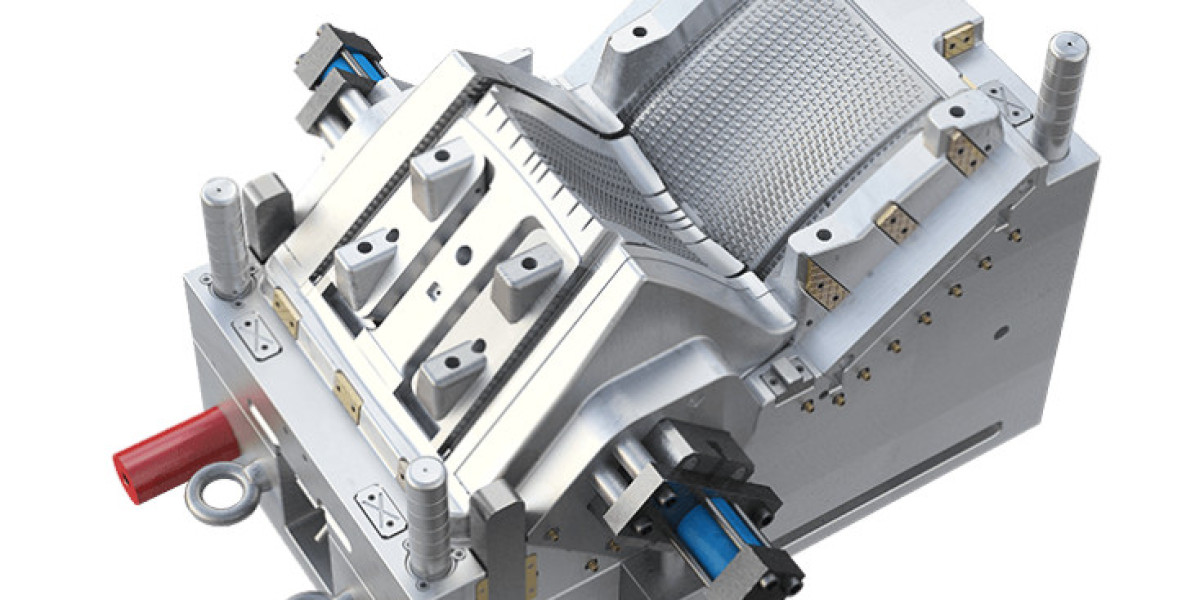

Beyond raw materials, the actual assembly of hypersonic weapons is a major bottleneck. We are currently in a "craftsman" phase of production, where highly skilled PhD-level engineers often hand-build components.

The "Hand-Made" Problem:

To achieve mass adoption, the industry must transition to automated manufacturing. However, the tolerances required for hypersonic flight are unforgiving. A microscopic imperfection in a thermal tile could lead to a catastrophic "zipper effect" where the heat shield peels off mid-flight. Developing automated robots capable of this level of precision is a new market vertical in itself.

Propulsion Scarcity:

The solid rocket motors (SRMs) needed to boost these weapons to hypersonic speeds are also in short supply. Following years of consolidation in the defense industry, the number of prime contractors capable of casting large SRMs has dwindled. This lack of competition has led to long lead times and high prices. New entrants and startups are now trying to disrupt this space by using 3D printing (additive manufacturing) to print rocket fuel grains, promising to cut production time from months to days.

The Testing Infrastructure Gap

Perhaps the most overlooked bottleneck is the inability to test what we build. You cannot test a hypersonic missile in a standard wind tunnel; the physics of air change fundamentally at Mach 5.

The Wind Tunnel Deficit:

There is a global shortage of wind tunnels capable of simulating hypersonic airflow and temperature simultaneously. Existing government facilities are often booked years in advance, creating a "traffic jam" for R&D programs. This has given rise to the "Testing as a Service" (TaaS) business model. Private companies are building their own high-speed wind tunnels and shock tubes, renting out time to defense contractors. This sub-sector is poised for explosive growth, as valid flight data becomes the most valuable commodity in the market.

Flight Test Limitations:

Real-world flight testing is expensive ($100M+ per launch) and geographically restricted to vast ranges over the ocean. This scarcity of data slows down the iterative design process. To counter this, the industry is pivoting toward Digital Engineering—creating "Digital Twins" of missiles to fly millions of virtual sorties in supercomputers before a physical prototype is ever built.

Workforce: The Talent Void

Finally, the machinery of war requires human hands. The aerospace sector is facing a "grey tsunami" as a generation of engineers who cut their teeth during the Cold War retires.

There is a critical shortage of young talent specializing in high-speed aerodynamics, thermodynamics, and guidance, navigation, and control (GNC). Hypersonic engineering is a niche field that was largely dormant for twenty years. Rebuilding this intellectual capital takes time. Universities are partnering with defense firms to create specialized curricula, but the "talent gap" remains a significant restraint on how fast companies can scale their operations.

FAQs

Why are rare earth elements so important for hypersonics?

They are used to create the powerful magnets inside the missile's actuators (fins) and guidance systems. These magnets must retain their magnetic properties even at high temperatures, which requires specific rare earths like Dysprosium.

What is a "Digital Twin"?

It is a virtual replica of the missile used for simulation. By testing the digital twin in a virtual environment, engineers can identify flaws and optimize designs without the cost and risk of physical flight tests.

Can 3D printing help?

Yes. Additive manufacturing is being used to create complex scramjet engine parts that have internal cooling channels impossible to machine with traditional methods. It also speeds up prototyping.

Conclusion

The Hypersonic Weapons Market is currently racing to catch up with its own ambitions. While the demand for these weapons is insatiable, the supply chain is straining under the pressure. The winners of the next decade will not necessarily be the companies with the fastest missiles, but the ones who can solve the logistical puzzle—securing raw materials, automating production, and closing the testing gap. For stakeholders, looking upstream at the suppliers of materials and testing infrastructure offers a strategic vantage point to capitalize on this defense revolution.

Browse More: