Brazil Third-Party Logistics Market Overview

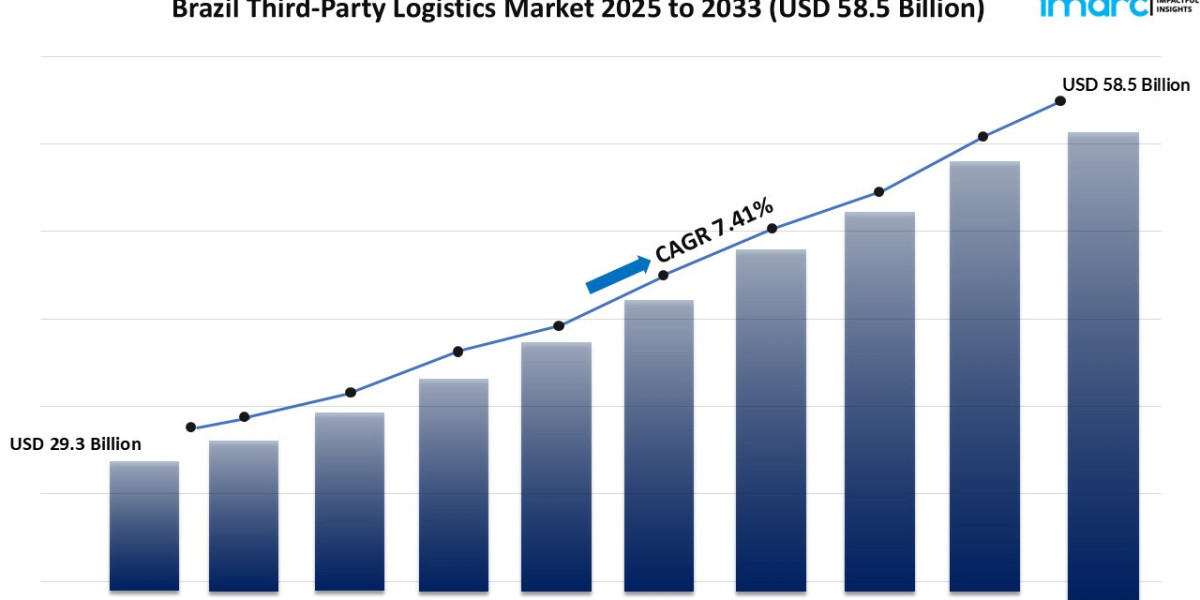

Market Size in 2024: USD 29.3 Billion

Market Forecast in 2033: USD 58.5 Billion

Market Growth Rate: 7.41% (2025-2033)

According to the latest report by IMARC Group, the Brazil third-party logistics market size was valued at USD 29.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 58.5 Billion by 2033, exhibiting a CAGR of 7.41% from 2025-2033.

Brazil Third-Party Logistics Industry Trends and Drivers:

Expanding Role of Third-Party Logistics in Brazil’s Supply Chain

The Brazil third-party logistics market is experiencing robust expansion as companies across multiple industries are increasingly outsourcing their transportation and distribution functions to specialized service providers. This shift is enabling businesses to optimize operational efficiency, reduce capital expenditure, and focus on core competencies while benefiting from advanced logistics networks.

The rapid growth of e-commerce is fueling demand for time-sensitive and flexible delivery services, pushing third-party logistics providers to adopt innovative solutions such as automated warehousing, route optimization software, and last-mile delivery tracking systems. Rising consumer expectations for faster, more reliable order fulfillment are encouraging logistics companies to invest in cutting-edge technologies that integrate real-time data analytics with inventory management. Government-backed infrastructure projects, including the expansion of highways, ports, and intermodal hubs, are enhancing connectivity across regions, enabling more efficient cargo movement.

Collaboration between logistics providers and retail platforms is streamlining supply chain processes, from procurement to final delivery, ensuring higher accuracy and customer satisfaction. The integration of sustainability practices, such as eco-friendly packaging and energy-efficient transport fleets, is also becoming a competitive advantage, aligning with corporate social responsibility objectives. As trade volumes continue increasing both domestically and internationally, the role of third-party logistics in ensuring reliable and scalable distribution is becoming a strategic necessity for Brazilian enterprises.

Technological Transformation Driving Logistics Efficiency

The third-party logistics industry in Brazil is undergoing a technological transformation that is redefining the way goods are stored, handled, and delivered. Providers are leveraging artificial intelligence, cloud-based platforms, and blockchain to enhance visibility, security, and transparency across supply chain operations. Predictive analytics is enabling companies to anticipate demand fluctuations, optimize inventory levels, and reduce delivery times while maintaining cost-effectiveness.

Smart warehouses equipped with automated picking systems and robotics are improving order accuracy and operational speed, particularly for high-volume e-commerce shipments. Real-time tracking technologies are empowering businesses to monitor shipment status at every stage, enhancing accountability and customer trust. Digital freight platforms are connecting shippers with carriers instantly, increasing route efficiency and reducing idle time.

The adoption of Internet of Things (IoT) devices in freight vehicles is providing data on fuel consumption, maintenance needs, and driver performance, contributing to lower operational costs and improved safety. Partnerships between technology firms and logistics providers are fostering the creation of integrated platforms capable of handling multimodal transportation seamlessly. Furthermore, the alignment of digital tools with sustainability initiatives—such as route planning to minimize emissions—is reinforcing the market’s role in supporting environmentally responsible business practices. This continuous integration of technology is enabling Brazil’s logistics sector to remain competitive in a rapidly evolving global trade environment.

Strategic Opportunities and Competitive Dynamics

The Brazil third-party logistics sector is positioning itself as a cornerstone of modern commerce by offering tailored solutions that address the distinct needs of various industries, including retail, manufacturing, automotive, and healthcare. Leading providers are differentiating themselves through value-added services such as customs brokerage, reverse logistics, and specialized handling for perishable or high-value goods.

The growth of cross-border trade within South America is opening new opportunities for multimodal transport solutions that combine road, rail, air, and maritime routes for maximum efficiency. Companies are also expanding their footprint into underserved regions, leveraging advanced distribution centers to reduce delivery times and costs. Strategic mergers and acquisitions are strengthening market presence, enabling providers to scale operations and enhance service capabilities. Workforce training programs are being implemented to ensure skilled personnel can operate advanced logistics systems and manage complex supply chains effectively.

The emphasis on end-to-end logistics solutions is creating long-term partnerships between shippers and providers, fostering deeper collaboration and innovation. Government incentives supporting infrastructure modernization and digital transformation are further boosting competitiveness. By aligning operational excellence with customer-centric strategies, the third-party logistics market in Brazil is establishing itself as a critical driver of economic growth, trade facilitation, and sustainable business expansion.

Download a sample copy of the Report: https://www.imarcgroup.com/brazil-third-party-logistics-market/requestsample

Brazil Third-Party Logistics Industry Segmentation:

The report has segmented the market into the following categories:

Transport Insights:

- Railways

- Roadways

- Waterways

- Airways

Service Type Insights:

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Distribution

- Value Added Logistics Services

End Use Insights:

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=30294&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145