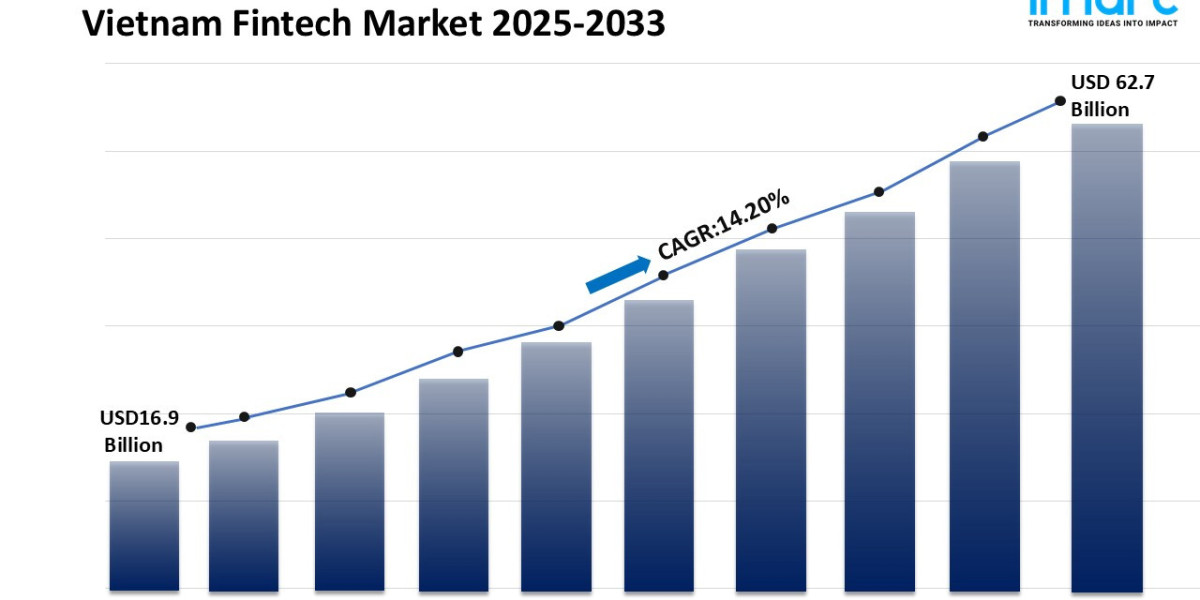

Vietnam Fintech Market Report

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 16.9 Billion

Market Forecast in 2033: USD 62.7 Billion

Market Growth Rate (2025-2033): 14.20%

The Vietnam fintech market size was valued at USD 16.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.7 Billion by 2033, exhibiting a CAGR of 14.20% during 2025-2033. Southern Vietnam currently dominates the market, holding a significant market share of 48.5% in 2024. The widespread smartphone adoption and increasing internet access are facilitating the market expansion. In addition to this, supportive government policies, a large unbanked population seeking digital solutions, growing foreign investment, rising e-commerce activities, improved digital infrastructure, evolving consumer preferences, and advancements in blockchain, AI, and payment technologies are some of the major factors augmenting the Vietnam fintech market share.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/vietnam-fintech-market/requestsample

Vietnam Fintech Market Trends and Drivers:

The Vietnam fintech marketplace is present process dynamic enlargement as virtual price adoption, economic inclusion efforts, and a young, tech-orientated populace are reshaping the economic offerings landscape. Startups and conventional economic establishments are taking part to roll out progressive answers in cell banking, peer-to-peer lending, e-wallets, and blockchain technology. Government assist is likewise gambling a critical role, with proactive regulatory frameworks and tasks designed to stimulate innovation, enhance economic literacy, and sell cashless transactions. As greater customers are gaining access to virtual systems, fintech offerings are accomplishing underserved rural populations, boosting each accessibility and convenience. Moreover, growing telephone penetration and net connectivity are permitting real-time economic answers, riding accept as true with and consumer engagement in virtual finance. These elements are positioning Vietnam as certainly considered one among Southeast Asia`s maximum promising fintech hubs, in which tech-pushed disruption is reworking traditional banking models.

At the identical time, america is substantially influencing the improvement of the Vietnam fintech marketplace through sharing technological expertise, capital investment, and enterprise models. U.S.-primarily based totally fintech groups are forming strategic alliances with Vietnamese companies to installation secure, scalable virtual systems that follow each worldwide requirements and neighborhood requirements. American task capitalists are investment Vietnamese startups with robust potential, fueling product improvement and marketplace enlargement throughout lending, coverage era, and virtual wealth management. In addition, U.S. price processors and cybersecurity companies are contributing superior technology that make stronger transaction infrastructure and guard virtual identities. These collaborations are fostering know-how trade, operational efficiency, and customer-centric product design—key pillars helping Vietnam`s virtual finance transformation. Through this bilateral engagement, Vietnam is gaining publicity to worldwide high-quality practices whilst tailoring answers that cope with the precise wishes of its rising center elegance and entrepreneurial communities.

The synergy among each markets is persevering with to boost up innovation, force regulatory modernization, and domesticate a colourful atmosphere for sustainable growth. Vietnamese fintech gamers are gaining knowledge of from U.S. successes in open banking, neobanking, and decentralized finance to provide inclusive and adaptive economic products. U.S. companies are viewing Vietnam as a gateway to broader nearby possibilities because of its robust financial basics and developing virtual appetite. This mutual trade is improving virtual infrastructure, diversifying economic offerings, and constructing patron accept as true with throughout the board. As a result, the Vietnam fintech marketplace is rising as a transformative pressure now no longer simplest locally however additionally as a strategic participant withinside the worldwide economic era landscape.

Vietnam Fintech Industry Segmentation:

Analysis by Type:

- Digital Payments

- Online Purchases

- POS (Point of Sales) Purchases

- Personal Finance

- Digital Asset Management Services

- Remittance/ International Money Transfers

- Alternative Financing

- P2P Lending

- SME Lending

- Crowdfunding

- Insurtech

- Online Life Insurance

- Online Health Insurance

- Online Motor Insurance

- Others

- B2C Financial Services Market Places

- Banking and Credit

- Insurance

- E-Commerce Purchase Financing

- Others

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=15044&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145